new mexico gross receipts tax rate

Albuquerque Metro Area Gross Receipts Tax range. In that way the gross receipts tax resembles a sales tax.

Gross Receipts Location Code And Tax Rate Map Governments

New Mexico has a gross receipts tax that is imposed on persons engaged in business in New Mexico.

. A space for the New Mexico Gross Receipts Tax Location Code has been added to NMAR Form 1106. TurboTax Is Designed To Help You Get Your Taxes Done. Instead it has a gross receipts tax.

Listing Agreement Exclusive Right to Sell for the listing REALTOR to fill in so that the proper amount of Gross Receipts Tax is computed and collected by the title company. View the current Gross Receipts Tax Rate Schedule. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT regimes.

The gross receipts tax rate varies throughout the state from 5 to 9 and frequently changes. Generally a business will pass that tax on to the consumer so that it resembles a sales tax. Liquor Pawnbroker License Holders.

The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. The current gross receipts tax rate in unincorporated portions of Sandoval County is 6375. If you are requesting a refund of tax previously paid you must also submit Form RPD-41071 Application for Refund with all required attachments to the.

Counties and cities can charge an additional local sales tax of up to 3563 for a maximum possible combined sales tax of 8693. The tax Imposed by this section shall be referred to as the compensating tax. Combined with the state sales tax the highest sales tax rate in New Mexico is.

On April 4 2019 New Mexico Gov. Other states have franchise taxes which are similar to income taxes. Supreme Court decision in South Dakota v.

New Mexico has a statewide gross receipts tax rate of 5125 which has been in place since 1933. The table below shows state county and city rates in every county in New Mexico as well as some of the largest cities. Only in its effect on the buyer does the gross receipts tax resemble a sales tax.

6375 8675 City of Albuquerque Gross Receipts Tax rate. Our advice is that you e-file and e-pay. The New Mexico state sales tax rate is 513 and the average NM sales tax after local surtaxes is 735.

Click here for a larger sales tax map or here for a sales tax table. The business pays the total gross receipts tax to the state which then. Depending on local municipalities the total tax rate can be as high as 90625.

Submit Current Contact Information. Of that amount 5125 is the rate set by the stateGross Receipts Tax Rate. The current gross receipts tax rate in unincorporated portions of Sandoval County is 6375.

Get Your Maximum Refund When You E-File With TurboTax. There are a few ways to determine the proper location code. What is the New Mexico gross receipts tax.

Identify the appropriate GRT Location Code and tax rate by clicking on the map at the location of interest. In general the gross receipts tax rate is origin-based determined by the business location of the seller or lessor not the location of the. Compensating tax is an excise tax imposed on persons using property or services in New Mexico also called use tax or buyer pays.

The Gross Receipts Tax rate varies throughout the state from 5125 to 94375. The statewide gross receipts tax rate is 5125 while city and county taxes can add up to a total of 4125. The gross receipts tax rate varies statewide from the state base of 5125 percent to 88125 percent.

If the gross receipts tax is increased to five and one-eighth percent pursuant to Subsection C of Section 7-9-4 NMSA 1978 the rate of the compensating tax shall be five and one-eighth percent. The maximum local tax rate allowed by New. Starting July 1 those businesses will pay both the statewide rate and local-option Gross Receipts Taxes.

The Gross Receipts map below will operate directly from this web page but may also be launched from the Departments Web Map Portal portal link located below the map. Select the GROSS RECEIPTS TAX RATES link for additional tax rate information and schedules. The gross receipts tax rate varies throughout the state from 5125 to 88675 depending on the location of the business.

The New Mexico NM state sales tax rate is currently 5125. The gross receipts tax doesnt deduct expenses. Since 2019 internet sales have been taxed using the statewide 5125 rate.

Gross Receipts Tax Compensating Tax Sales Use Tax. Use a Tax Rate Table. Most New Mexico -based businesses starting July 1 must now also use destination sourcing.

New Mexico does not have a sales tax as known in many other states. What is the gross receipts tax rate in Albuquerque NM. Pawn Second Hand Precious Metal Dealers Permits.

New Mexico has state sales tax of 5125 and allows local governments to collect a local option sales tax of up to 7125There are a total of 134 local tax jurisdictions across the state collecting an average local tax of 2257. How to use the map. If not you should be filing form TRD-41413 Gross Receipts Tax Return.

Gross Receipts Tax Rate Schedule. How to Claim a Refund When You Are Also Required to E-File Your Return. Anything over 5125 percent represents local option rates imposed by counties and municipalities.

The changes to the GRT came primarily in response to the US. The business pays the total Gross Receipts Tax to the state which then distributes the counties and. Municipal governments in New Mexico are also allowed to collect a local-option sales tax that ranges from 0 to 9062 across the state with an average local tax of 2257 for a total of 7382 when combined with the state sales tax.

New Mexico Gross Receipts Quick Find is available. Groceries are exempt from the New Mexico sales tax. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located.

Ad Free For Simple Tax Returns Only. It varies because the total rate combines rates imposed by the state counties and if applicable municipalities where the businesses are located. New Mexico has 419 special sales tax jurisdictions with local sales taxes in addition to the.

That means Sandoval County receives roughly slightly more than a penny for every dollar in taxes paid for a business transaction in the county with the state receiving a little more than five cent. Of that amount 5125 is the rate set by the state. This tax is imposed on persons engaged in business in New Mexico but in almost every case the person engaged in business passes the tax to the consumer.

Pay Parking Citations Excavation Barricade Permits Health Permit Renewal Alarm Fees. State of New Mexico Gross Receipts Tax Rates.

Data Suggest N M Still Slogging Toward Recovery Data Infographic Recovery

A Guide To New Mexico S Tax System New Mexico Voices For Children

Gross Receipts Location Code And Tax Rate Map Governments

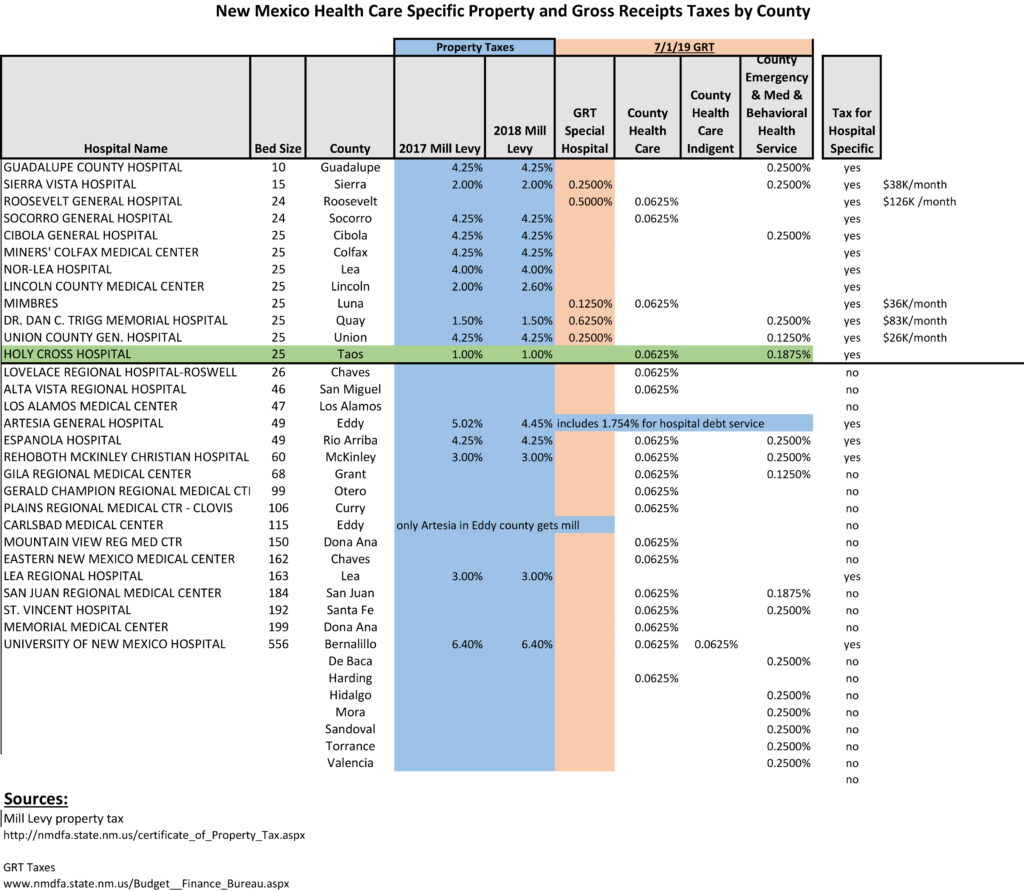

Property And Gross Receipts Taxes By County Holy Cross Medical Center

New Mexico Gross Receipts Tax Nmgrt Law 4 Small Business P C L4sb

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors

Lawmakers Taking Cautious Approach To Plan To Cut Grt Albuquerque Journal

How To File A Gross Receipts Tax Grt Return In Taxpayer Access Point Tap Youtube

New Mexico Sales Tax Small Business Guide Truic

Tax Rates Climb Amid Debate Over Revising State Code Albuquerque Journal

A Guide To New Mexico S Tax System Executive Summary New Mexico Voices For Children

Nm Grt Tax Rate Schedule Updated For January 2020 Gaar Blog Greater Albuquerque Association Of Realtors