boulder co sales tax efile

Selling My Soap Saturday July 24 2021 115407 AM Longmont Boulder County. There are a few ways to e-file sales tax returns.

Sales tax returns must be filed monthly.

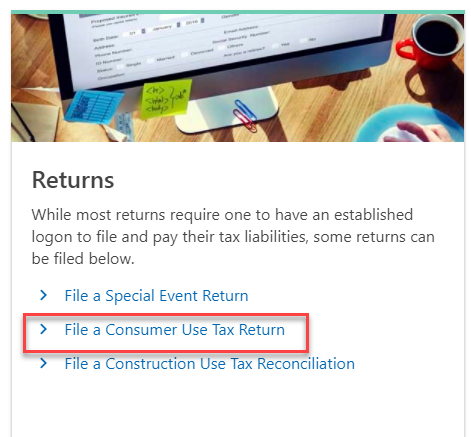

. The City of Boulder is considered a home-rule city meaning it administers Boulder sales tax separately from the State of Colorado. Please visit the Colorado Department of Revenue website for more information or for required forms. The Boulder Online Tax System offers enhanced user experiences and tax compliance functionality to city businesses including the ability to.

For tax rates in other cities see Colorado sales taxes by city and county. Sales 000 of line 4 000 000 5C. The minimum combined 2022 sales tax rate for Boulder Colorado is.

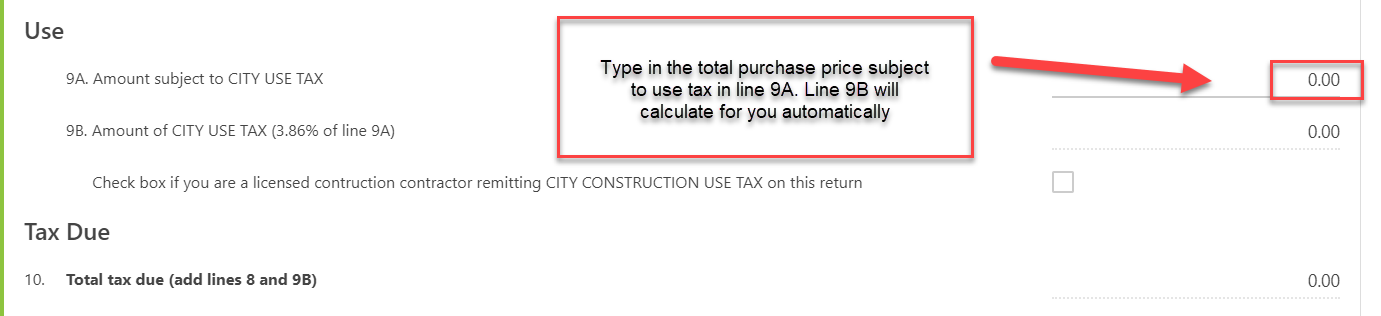

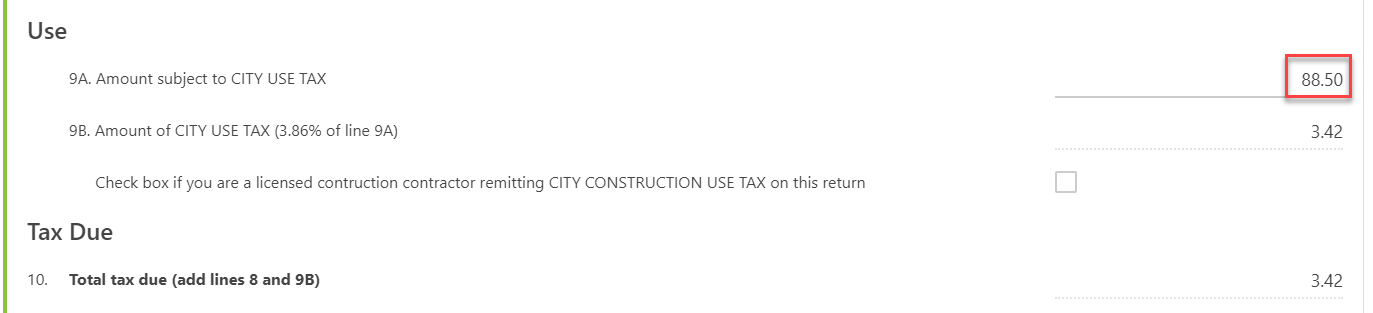

The city use tax rate is the same as the sales tax rate. Some cities and local governments in Boulder County collect additional local sales taxes which can be as high as 51. A lessor may request permission from the Department to acquire motor vehicles tax-free on the condition that the lessor.

As a statutory Town the Town of Eries sales tax is collected by the State of Colorado. 1375 Series 2002 Historic Preservation Tax 2009 - Ordinance No. Use tax is intended to protect local businesses against unfair competition from out-of-city or state vendors who are not required to collect City of Boulder sales tax.

File online tax returns with electronic payment options. If you have more than one business location you must file a separate return in Revenue Online for each location. For assistance please contact the Sales Tax Office at 303-651-8672 or email SalesTaxLongmontColoradogov.

Sales tax is a tax collected on all retail transactions. The Boulder sales tax rate is. 300 or more per month.

There is a one-time processing fee of 25 which may be paid by cash or check. The Colorado sales tax rate is currently. However a lease for a term of 36 months or less is tax-exempt if the lessor has paid Colorado sales or use tax on the acquisition of the leased vehicle.

Sales and are subject to Colorado sales tax. Excess Tax Collected 000 7. Sales and Use Tax 2002 - Ordinance No.

Complete a Business License application or register for a Special Event License. Boulder County has one of the highest median property taxes in the United States and is ranked 437th of the 3143 counties in order of median property taxes. County road and transit improvements.

The COVID-19 pandemic resulted in significant business shut-downs in the final week of March 2020 and all of April 2020 and May 2020. For questions about city taxes and licensing please call the City Boulder Sales Tax Division at 303 441-3051 email at salestaxbouldercoloradogov or send a message through Boulder Online Tax. Jail improvements and operation.

You can print a 8845 sales tax table here. Non-profit human service agencies. 1544 Series 2008 Sales and Use Tax 2011 -.

Total Boulder County tax rate. Boulder County Sales Taxes. The Assessors Office calculates the amount of those taxes determines property values and handles property tax exemptions for seniors and disabled veterans.

Businesses that pay more than 75000 per year in state sales tax. Amount of city FOOD SERVICE TAX 015 of line 5B 6. Longmont Sales Tax Division 350 Kimbark St Longmont CO 80501.

The Boulder Colorado sales tax is 885 consisting of 290 Colorado state sales tax and 595 Boulder local sales taxesThe local sales tax consists of a 099 county sales tax a 386 city sales tax and a 110 special district sales tax used to fund transportation districts local attractions etc. Between 2009 and 2019 sales tax revenues in the city had steadily increased with the exception of a flattening between 2016 and 2017. Senior Tax Worker Program.

For questions about state taxes please call State of Colorado Taxpayer Services at 303 238-7378. Return the completed form in person 8-5 M-F or by mail. The Boulder County Sales Tax is 0985.

With proof of payment sales tax paid to another tax jurisdiction may be credited against consumer use tax due for a particular item. City of Boulder Sales Tax Form. Therefore all businesses engaged in business in the city must have a City of Boulder business license.

For additional e-file options for businesses with more than one location see Using an. This is the total of state county and city sales tax rates. E-File Today Get Your Tax Refund.

E-File Your Taxes Online. Boulder County collects on average 057 of a propertys assessed fair market value as property tax. The County sales tax rate is.

Get started with a sales tax boulder form 0 complete it in a few clicks and submit it securely. The Senior Tax Worker Program allows senior taxpayers to work in county offices to help pay their county taxes. A county-wide sales tax rate of 0985 is applicable to localities in Boulder County in addition to the 29 Colorado sales tax.

Monthly returns are due the 20th day of month following reporting period. The Boulder Sales Tax is collected by the merchant on all qualifying sales. The 8845 sales tax rate in Boulder consists of 29 Colorado state sales tax 0985 Boulder County sales tax 386 Boulder tax and 11 Special tax.

To set up any or the above or a federal tax ID number also called an Employer Identification Number or EIN contact our nearest tax id filing office at Local Boulder Tax ID Number Office or. After you create your own User ID and Password for the income tax account you may file a return through Revenue Online. 13 rows Boulder County Office of Financial Management Sales Use Tax 303-441-4519 Sales Tax.

The median property tax in Boulder County Colorado is 2014 per year for a home worth the median value of 353300. Sent direct messages to Sales Tax Staff. You may also contact them via phone.

File Sales Tax Online Department Of Revenue Taxation

6 Steps To State Sales Use Tax Compliance In The Wake Of Wayfair

State Local Tax Services Across Jurisdictions Bdo Tax

Taxes In Boulder The State Of Colorado

The Standard Deduction Is Rising For 2020 Here S What You Need To Know The Motley Fool Standard Deduction Filing Taxes Tax Return

The Freelancer S Tax Guide For 2016 Infographic Tax Guide Income Tax Preparation Business Tax

Salvatore Ferragamo S Museum New Exhibit Spotlights Silk Accessories Wwd

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

File Sales Tax Online Department Of Revenue Taxation

Where To File Sales Taxes For Colorado Home Rule Jurisdictions Taxjar

File Sales Tax Online Department Of Revenue Taxation

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

The Best Places To Retire In 2021 In 2022 Best Places To Retire Retirement The Good Place